A sustainable business model in the UK today is rarely born from a single strategy. It emerges at the intersection of resilience, ethical practice, and foresight. For companies like Innocent Drinks or Interface Carpets, the story is familiar: long before climate targets became mainstream, their leaders were quietly asking whether profit could be married to purpose. Some attempts succeed with a flourish, others falter quietly, their efforts swallowed by the very market forces they sought to outsmart.

Consider the supply chain. A firm may tout a commitment to sustainable sourcing, but the real test comes when prices spike or a supplier falters. Those who endure are not the ones who simply label products as “green”; they invest years into building relationships, auditing practices, and innovating around materials and logistics. There’s a quiet thrill in seeing a factory shift from conventional inputs to recycled alternatives and discovering it costs less in the long run. That lesson—that short-term sacrifice often seeds long-term gain—is at the heart of sustainable business strategy.

Financial prudence is another pillar. Many observers assume sustainability is synonymous with higher costs, yet the UK business scene shows otherwise. Reducing energy consumption, rethinking packaging, and streamlining operations can boost margins without compromising principles. Companies that view these adjustments as investments, not burdens, are often the ones creating long-term value. It’s a nuanced dance: balancing profit expectations with patience for change, and accepting that the timeline for returns may stretch over a decade rather than a quarter.

Cultural integration within a company is just as critical. Employees who understand the “why” behind sustainability initiatives become advocates rather than compliance officers. I remember visiting a mid-sized manufacturing firm in Manchester where the energy manager casually mentioned that staff would check equipment efficiency even on weekends. It wasn’t mandated. They cared. The subtle shift from rule-following to intrinsic motivation is a defining trait of a business model that will endure.

Consumer perception is no longer peripheral. In the UK, shoppers increasingly scrutinize brands, from their carbon footprint to the ethics of overseas suppliers. A sustainable business model cannot ignore this. But it also cannot pander. The companies that thrive convey transparency rather than perfection. They admit missteps, explain adjustments, and gradually win trust. It’s a slow accumulation of credibility, not a single launch campaign, that converts awareness into loyalty.

Innovation plays a dual role. It fuels efficiency and also differentiates the brand in competitive markets. For instance, a startup introducing modular design in furniture or refillable packaging in personal care products demonstrates how creativity can intersect with sustainability. These innovations are rarely flashy in conventional business reports, yet they compound over years, fortifying both the balance sheet and brand equity.

External pressures—regulatory, social, and environmental—shape the contours of a sustainable model. In the UK, government policies and incentives for low-carbon operations nudge companies toward responsible behaviour. Yet firms that only react to policy risk missing the deeper opportunity: embedding sustainability as a core value. True long-term value is rarely created by compliance alone; it is nurtured by foresight and imagination, by leaders willing to envision operations decades ahead rather than quarters.

Risk management is woven into this fabric. Climate-related disruptions, fluctuating material costs, and changing consumer sentiment are no longer hypothetical. Companies with sustainable business models anticipate these variables, diversify supply chains, and build buffers into financial and operational plans. It is a kind of disciplined optimism: acknowledging uncertainty while structuring the business to absorb shocks gracefully.

One often overlooked element is scalability. A model that works in one UK city may falter when extended nationwide—or globally. Sustainable operations require adaptability. Standardised procedures must coexist with local insight, and the constant feedback loop ensures decisions remain relevant. Observing how some businesses pivot while others stagnate can be revealing: flexibility, not rigidity, often marks those that endure.

Stakeholder engagement is equally decisive. Shareholders, employees, suppliers, and customers each bring expectations, and the most sustainable models harmonise these voices without sacrificing coherence. Conflicts are inevitable, but the approach matters. Open dialogue, transparent reporting, and participatory decision-making transform potential friction into momentum. The cumulative effect of these relationships over time often outweighs the immediate financial headline.

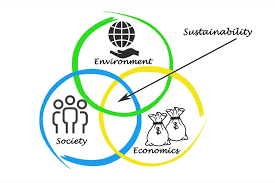

Sustainability also carries an ethical undertone that cannot be ignored. Environmental responsibility is intertwined with social and governance standards. When companies treat workers fairly, minimise ecological impact, and operate with integrity, the ripple effects touch communities, regulators, and markets alike. Over time, this alignment between principle and practice not only mitigates reputational risk but also attracts talent, partners, and customers who share similar values.

Profit and purpose are not mutually exclusive. In fact, in most UK examples I have tracked, they reinforce each other. The challenge lies in maintaining patience while ensuring accountability. Investors may demand quarterly returns, yet sustainable business models often accrue value more subtly, through efficiency gains, brand loyalty, and reduced operational shocks. Those gains, when compounded over decades, can be transformative.

A sustainable business model in practice is therefore less a blueprint than a living system. It requires constant observation, iteration, and sometimes humility. Companies must ask uncomfortable questions, invest in the unseen, and accept that the payoff is neither immediate nor guaranteed. But for those that persist, the payoff is enduring: a resilient enterprise that generates long-term value not only for shareholders but for society at large.