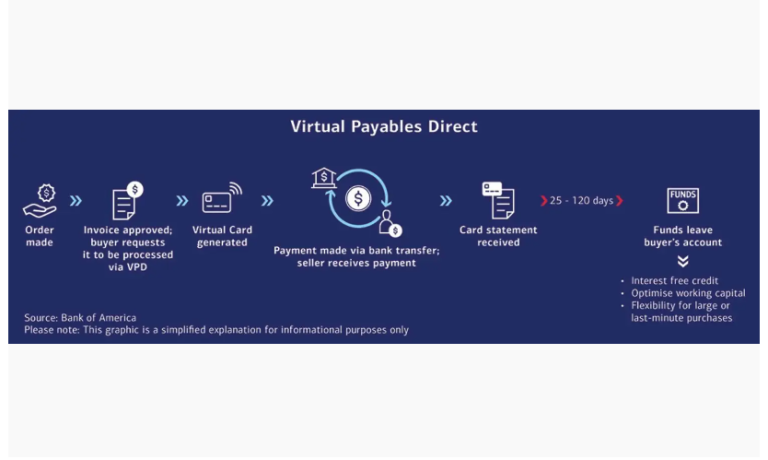

Bank of America has announced the expansion of its Virtual Payables capabilities across the EMEA region with the launch of Virtual Payables Direct, a new payment solution designed to give businesses more flexibility in managing their financial transactions. The solution enables buyers to make business-to-business (B2B) payments through direct bank transfers, providing the benefits of extended payment terms while allowing suppliers to receive funds promptly.

The launch comes amid significant growth in the global B2B payments market, which is forecast to exceed US$2.4 trillion by 2031. Bank of America’s new product is set to meet the growing demand for more efficient, secure, and flexible payment solutions.

Virtual Payables Direct allows businesses to make card payments to any supplier, even those that do not typically accept card transactions. According to Chris Jameson, head of Product Management for Global Payments Solutions (GPS) EMEA at Bank of America, the solution enables payments to be processed earlier in the procurement cycle, which can enhance supplier relationships and allow buyers to take advantage of prompt payment discounts.

“Virtual Payables Direct offers our clients in EMEA greater flexibility as they can make card payments to any supplier in the region, regardless of whether the supplier typically accepts card payments,” said Jameson. He added that the new system will help buyers to manage working capital more effectively and improve operational efficiency.

The solution also provides significant benefits for corporate treasurers, who have increasingly focused on optimising working capital. Virtual Payables Direct allows businesses to handle large, one-off, or last-minute payments, with suppliers receiving fast payments through direct bank transfers. This, in turn, helps all parties better manage their cash flow, improving financial stability and operational processes.

A major benefit for suppliers is that the system eliminates the need for any technical set-up to process card payments, making it easier for them to accept payments without additional complications. At the same time, buyers gain the advantage of extended payment terms, making the solution particularly appealing for companies managing complex supply chains or high-volume transactions.

Duygu Tasdelen-Stavropoulos, Senior Product Manager for B2B and Payables at GPS EMEA, explained that Virtual Payables Direct is designed to streamline payment processes, reduce complexity, and minimise the costs and risks typically associated with payment acceptance. “We’re pleased to expand payment options for our clients with this new capability. Virtual Payables Direct will contribute to the considerable benefits of virtual card payments, such as streamlining and automating processes, and reducing payment acceptance complexity, risk and costs,” she said.

Bank of America has indicated that further enhancements to Virtual Payables Direct are planned for 2025, alongside a broader rollout of the service to additional regions.

As companies across the EMEA region look to enhance their financial operations, Bank of America’s latest offering provides an innovative solution to help businesses optimise working capital and improve the efficiency of their payment processes.

Visit the bank’s website for more information about the bank’s Card and Comprehensive Payables solutions.